Renters Insurance in and around Plano

Welcome, home & apartment renters of Plano!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Your belongings are important and so is keeping them safe. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your TV to your hiking shoes. Unsure how to choose a level of coverage? That's alright! Ann Dunham wants to help you evaluate your risks and help find insurance that is reliable and a good fit today.

Welcome, home & apartment renters of Plano!

Coverage for what's yours, in your rented home

Why Renters In Plano Choose State Farm

Renting a home makes the most sense for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance may cover damage to the structure of your rented home, but that doesn't cover the things you own. Renters insurance helps guard your personal possessions in case of the unexpected.

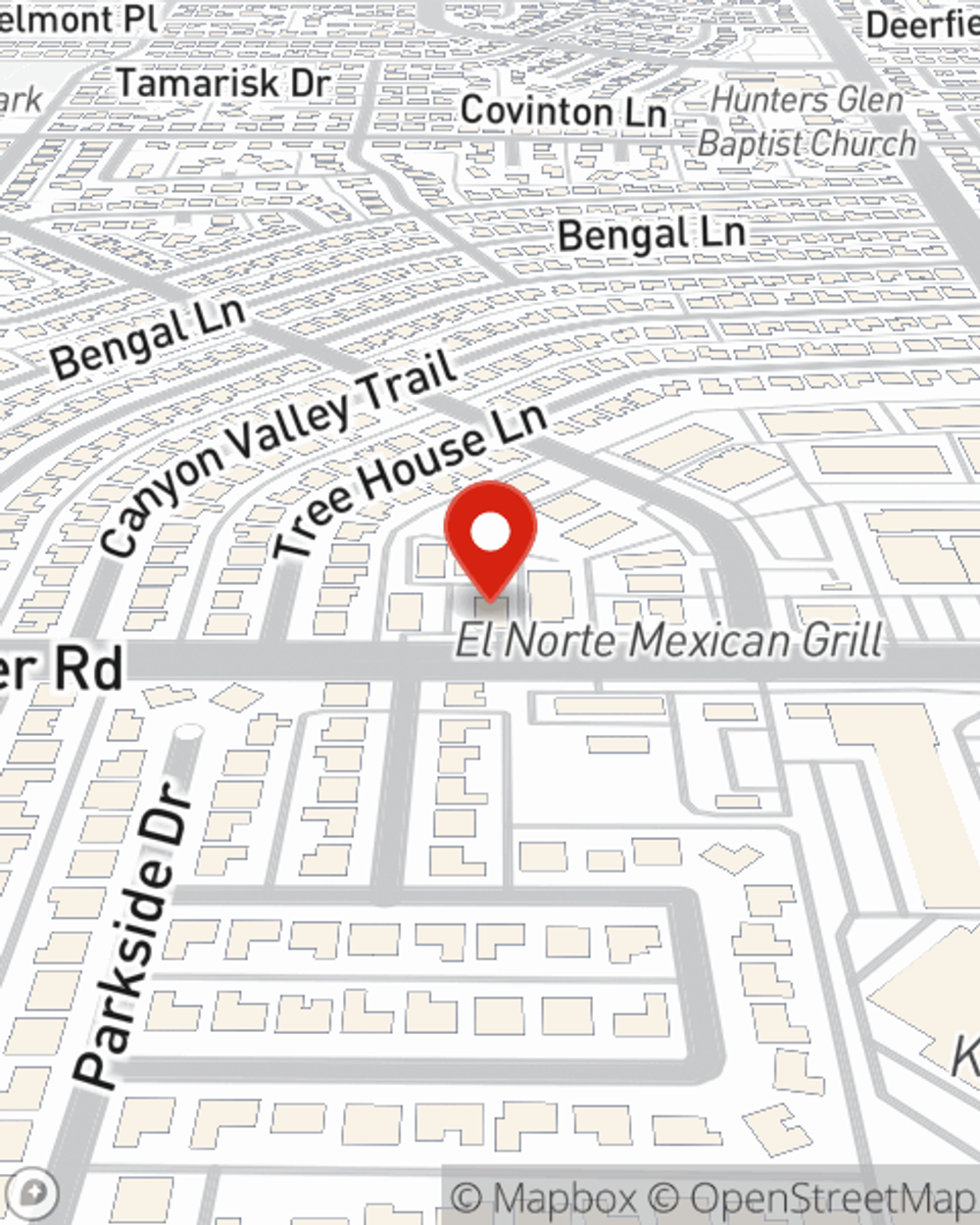

More renters choose State Farm® for their renters insurance over any other insurer. Plano renters, are you ready to discuss your coverage options? Get in touch with State Farm Agent Ann Dunham today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Ann at (972) 596-4809 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.